Can We Avoid A Nursing Home Spend Down? - Ask The Attorney

Jan 31, 2017

This article about nursing home spend downs by Michigan estate planning and elder law attorney Nicole Wipp and the Family and Aging Law Center is not legal advice. It is for informational purposes only. For legal advice on your situation, consult with a qualified elder law attorney.

How Do We Avoid A Total Nursing Home Spend Down?

Q: I’ve been told that if either of my parents needs nursing home care, we have to spend all of their money. Is this true? Can we legally protect some of my parent’s money?

A: The answer is, without a proper, legal plan, you do have to engage in what is called a “Spend Down.” How much your parents are allowed to keep depends on whether both of them are still alive, or if they are single.

Either way, there are perfectly legal ways of protecting money that can avoid a total spend down. This is crucial if the concern is that the remaining spouse doesn’t become impoverished by the need for the sick spouse’s care, or to ensure that whoever remains receives the best care possible.

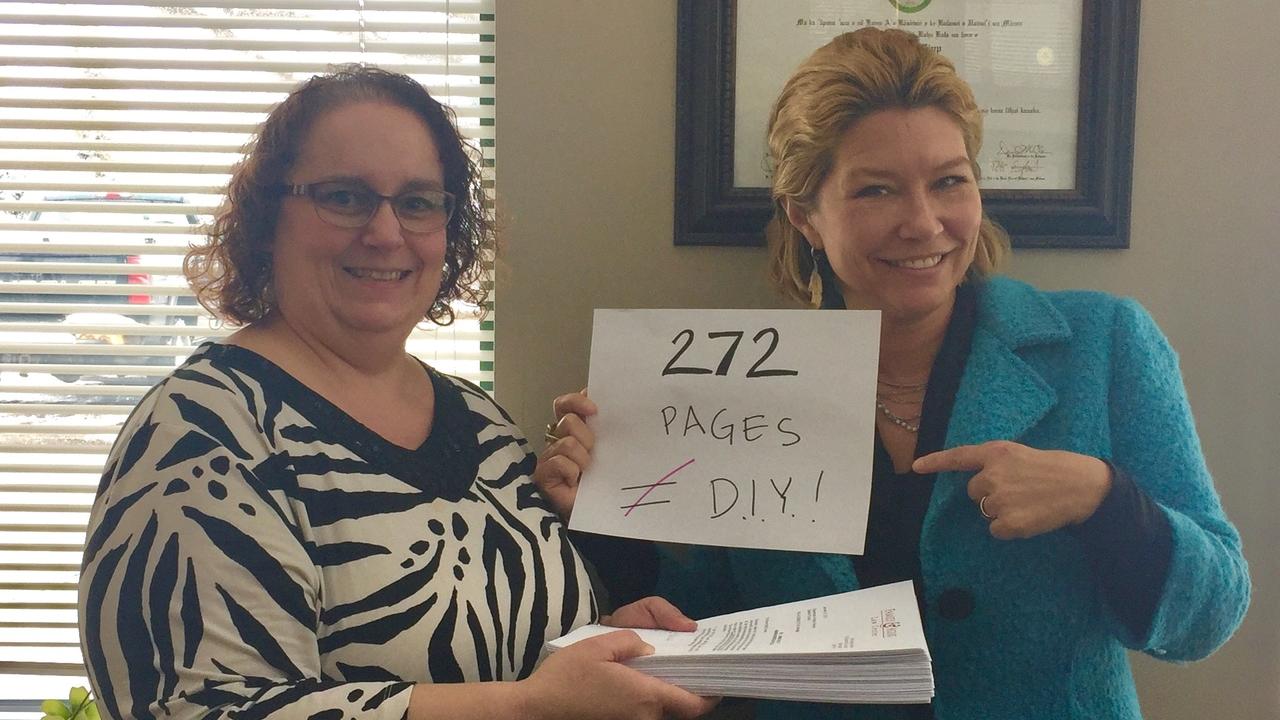

This involves careful legal planning, but it can be done by an experienced attorney - like us!